Note: I am reviewing a Citibank Philippines card. This Citibank Prestige card might or might not be similar to other countries’ Citibank Prestige

If you are currently in the market for a new credit card for traveling, one of the best cards that you can get is this Citi Prestige Credit Card if you would be expecting to travel more this year. It offers an array of exclusive benefits such as lounge benefits, meet and greet benefit, complimentary rounds of golf.

Other countries offer almost identical benefit such as Citibank Thailand or Citibank Singapore while other banks offer almost the same spread of benefits such as Chase Sapphire Reserve (USA).

Benefit

Priority Pass Membership

PriorityPass is basically a lounge access provider that offers lounge benefits to over 1000 lounges worldwide. Most major airports will have one or more lounges affiliated with this provider. As for Citi Prestige, it offers a complimentary unlimited access to PriorityPass lounge and four free access to your guest. If you are not yet an elite airline member, the next best option for enjoying your stay in the airport is through Priority Pass. I have personally used PriorityPass more than ten times already and the process is smooth as always. You just have to present your card or use your digital card saved on your phone.

Fourth Night Free

If you will be traveling for more than four nights, another benefit of Citi Prestige is getting your fourth hotel night stay for free. You will simply have to call the Citi Prestige concierge and they will handle the booking for you. Citibank has partnered with a premiere concierge service thus you can expect a first class service. I have tried booking a room via the concierge and they provided the list of possible hotels near the area. If you already have a target hotel in mind, the booking process is very quick. However, if you are not familiar with the place or the hotels near the area, the discussion might be challenging. In the end, I found out that they are searching hotels via Hotels.com. The prices are competitive and the fourth night free is a huge plus. My tip is, if you would try this service, check out the site first to know how much the price is.

Three ThankYou Points = 1 Airline Miles

Similar to any other credit cards, this card also provides 1 ThankYou point per 30 pesos spent and 5x ThankYou points on dining, shopping and spending abroad. If you are traveling frequently, then you can leverage on this one. Again, this is pretty standard across most credit cards except for the next benefit

120,000 Signup bonus

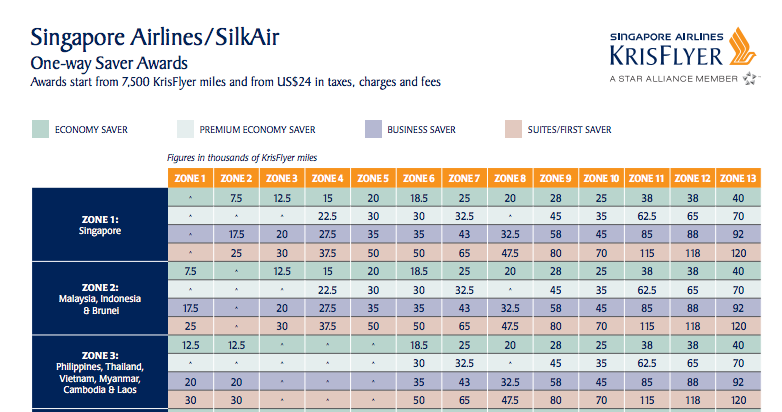

If there’s a reason why you should get this card, it’s because of the sign-up bonus. You will have to spend Php 25,000 (around US$500) to get this bonus point. You can convert this to airline miles or other benefits such as cash credits or hotel stay, etc. If you are planning to travel a lot, you can convert this to 40,000 airline miles. Just to give an example, a round-trip ticket award via StarAlliance airlines (ie. Singapore Airlines, Thai Airways, Lufthansa, etc) from Manila to Japan is around 50,000 points. The round trip business class award from Manila to Singapore is 40,000. The redemption cost is about $24. There’s a promo right now with KrisFlyer with discounted miles redemption (10% discount).

KrisFlyer Awards chart

Other Benefits

I bulked the rest of the benefits because it’s either I haven’t tried to use them or I don’t really need them. You are entitled to three complimentary rounds of golf but I don’t play golf. You are entitled to two Meet and Assist Service wherein someone from the Airport will assist you with the whole airport process. I haven’t tried this one though. You are also entitled to twice a year complimentary one way luxury transport from airport to your destination (within the 10 mile distance). I haven’t tried this one as well.

The Catch

There’s one catch though, it costs Php 12,000 per year payable on the first billing statement and every anniversary. There’s no way to avoid this one though.

Cost Benefit Analysis

Cost: Php 12,000 up front

Benefit:

- PriorityPass Prestige Membership – US$399 (Php 20,000).

- If you didn’t get Citi Prestige and you don’t have PriorityPass, the average cost of pay-in lounge is around Php 1,500 to Php 2,000. For example, the cost of HKIA Plaza Premium Lounge is Php 2,600. In Singapore, it ranges from Php 1,150 to 1,800. If you are planning to travel at least four times a year, the total cost of lounge pay-in is approx. Php 12,000 (average Php 1,500 x 4 trips x two ways)

- Round trip from Manila to Singapore in business class = Php 72,000 vs Round trip from Manila to Singapore in business class via Star Alliance points = 40,000 points + Php 2,000 (US$24)

Total Benefit: Php 93,000

Cost vs Potential Benefit: Php 12,000 vs Php 93,000

Verdict

Yes: If you are planning to travel frequently and you can afford to pay the membership cost of Php 12,000. In essence, the membership cost that you are paying Citibank is for the PriorityPass membership (which actually costs more than Citi Prestige membership) and the sign-up point.

No: If you are not planning to travel or your income and spending plans are not yet high. If you cannot spend Php 25,000 and will not travel (thus will not use PriorityPass), you might as well choose a “No Annual Fee for life” card.

Leave a Reply